Table of Content

The statement of house loan from Axis Bank eventually appears after inputting the details. You would be able to download the home loan statement and then access, examine, save, or print it. If excess amount is up to INR 20,000, Loan account would be closed by the Bank and after closure, excess funds would be credited to the Loan repayment account. For all loans linked to REPO rate, the reset frequency would be three months or as decided by the Bank, whichever is earlier.

In case of decrease in MCLR on the reset date, the ROI will decrease which in turn will impact the EMI/tenor of the loan as per Bank’s policy and will be communicated to the customer. In case of increase in MCLR on the reset date, the ROI will increase which in turn will impact the EMI/tenor of the loan as per Bank’s policy and will be communicated to the customer. Property papers will be handed over to you at Axis Bank Loan center within 15 days from the date of repayment of all dues. Download the Axis Mobile Application or log onto Internet Banking to get access to all account details pertaining to the loan. FeaturesLoans with 2 years fixed + floating rate of interest. FeaturesAffordable home loans for both Salaried and Self Employed customers.

Domestic Fixed Deposit

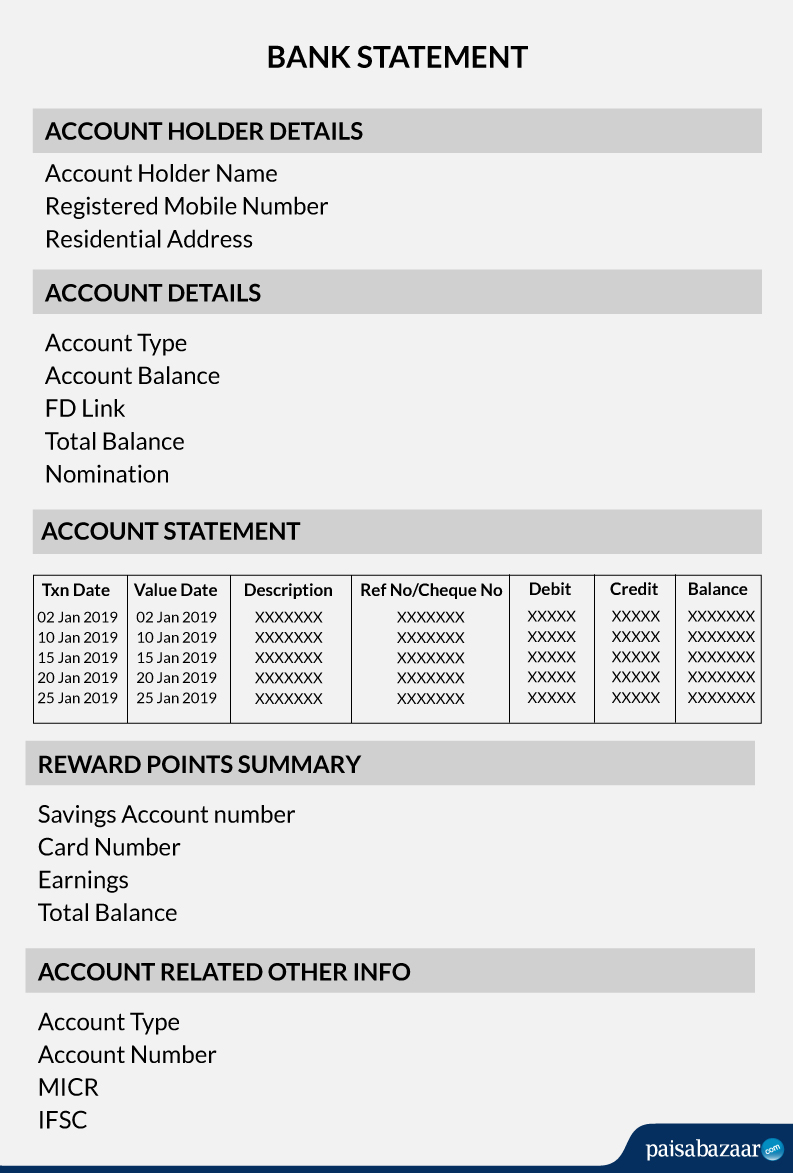

Balance processing fee as applicable shall be collected at the time of loan disbursement. Home loan statement of Axis Bank gives details of the loan including Customer ID, customer details like PAN number, date of birth and loan account number. The loan statement is usually sent via email or can also be attained online. You can also place a request for your Axis Bank Personal Loan statement at one of the nearest Axis Bank Loan Centres.

We'll ensure you're the very first to know the moment rates change. You will receive a call shortly from our customer support. You will be redirected to a new web page wherein you will be required to fill up a form with your registered email ID, name, and registered mobile phone number. Followed by this, will be field wherein you can fill up either of your Customer ID or Loan Account Number.

Axis Bank Personal Loan Account Statement

Based on your request, the bank will send you the loan statement to either your registered email ID or your correspondence address. You can also request for your loan account statement through the Web Chat facility offered by Axis Bank on their website. To avail this facility, follow the first five steps mentioned in the previous section. (Please note that UPI payments can only be made towards alphanumeric loan accounts.) Initiate a pay transaction on BHIM Axis Pay or any other UPI enabled banking App. On signing up for an E-Statement, you are eligible to receive consolidated account statement under your customer ID.

Axis Bank home loan borrowers can view all the details about their Bank home loan statement. This document is also known as the Axis Bank home loan provisional certificate. The rate of interest offered to you for your loan shall be the aggregate of REPO rate plus spread. It may be noted that the REPO rate would be reset every three months or as decided by the Bank, whichever is earlier.

Super Saver Home Loan

The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. A list of transactions, including any fees or penalties that may have been assessed throughout the loan’s term, is also shown. You need to select the “Enquiries” option after logging in. Visit the official website or the net banking platform of Axis Bank first. Would remain constant till the next reset date i.e Oct 2016.

Schedule monthly e-statements and receive e-statement for personal banking right on your smartphone or laptop. You can also get instant access to your e-statements by logging on to the official website, internet banking or sending a simple SMS. Axis Bank is one of the biggest private sector banks in India. In fact, it is the third-largest private bank in the country.

Home Loan EMI Calculator

In line with the above circular, Axis Bank has adopted Repo rate as the external Benchmark lending rate with effect from October 01, 2019. You can visit us in person at your nearest Axis Bank Loan Center along with an original and self-attested copy of your new address proof and photo identity. Yes, resident Indians are eligible for tax benefits on both the principal and the interest of a Home Loan under the Income Tax Act. The EMI consists of the principal amount and the interest on the balance outstanding amount. Since only a part of your loan has been disbursed, the interest component of your EMI will be proportionately lower to reflect this. Axis Bank will convey its decision within 30 working days from the date of receipt of the application provided the application is complete.

Further, the Bank shall have absolute right to decide and apply the spread over the REPO rate, ”Spread” shall consist of credit risk premium , operating costs and other costs. The spread will be reset periodically once in three years from the date of disbursement. Your credit risk premium shall be reviewed by the Bank at regular intervals and shall undergo a revision in case of a substantial change in your credit assessment. The EMI consists of the principal amount and the interest on the balance outstanding.

Yes, you can make a part-prepayment towards your Home Loan at your nearest Axis Bank Loan Center. If you are on a floating interest rate, no charge will be applicable. If you are on a fixed rate of interest, please check the charge applicable by clicking here If you are on a fixed rate of interest, please check the charge applicable. Total Processing fees of 1% of the outstanding principal with a minimum of Rs. 10,000 plus GST as applicable will be charged. Upfront processing fee of Rs 5000 plus GST shall be collected at the time of application login. This fee will not be refunded under any circumstances such as loan rejection/withdrawal of the loan application etc., non disbursement of loan for the reasons solely attributable to the customer.

To check the charge applicable for the foreclosure, please click here for check the charge applicable for the foreclosure . Once all outstanding dues have been cleared, please submit a foreclosure request at the Loan Center, and we will begin processing your request. FeaturesHome loan with overdraft facility to save total interest payable on your home loan. Get additional financing on the same property for personal or business requirements.

All views and/or recommendations are those of the concerned author personally and made purely for information purposes. Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. The bank will authorise and release your loan after the loan amount and the requested property have been verified. If you are already repaying a home loan and need funds in a hurry, take a top-up home loan....

Pre-EMI interest is the interest on the loan amount disbursed by the bank. It is payable every month from the initial date of disbursement until the commencement of the EMI payments. How can I know if there is an Axis Bank Loan Centre near me? You can use the locator facility offered by Axis Bank to find out the Axis Bank Loan Centre which is near you. You will be required to visit the official website of the bank and go to the 'Locate Us' section.

Once this process is taken care of, you can click on the 'Submit' button to send the email. Request your loan statement by entering your registered email address and cellphone number. Here is how to view and download Axis Bank home loan statement. Yes, MCLR can be different between different banks as it will depend on marginal cost of funds, negative carry on account of CRR, operating costs, tenor premium of respective banks.

The advantage of loans with an EMI plan is that they help you plan your purchases and gradually clear your dues towards it. However, in the face of any exigency it is possible that you could miss an EMI payment. Axis Bank shall not be liable or responsible for any breach of secrecy caused as a result of the e-statements being sent to the registered email with the Bank. The E statement provided is an optional facility provided to the account holders and not a compulsion by the Bank for availing such a facility. These articles, the information therein and their other contents are for information purposes only.

No comments:

Post a Comment